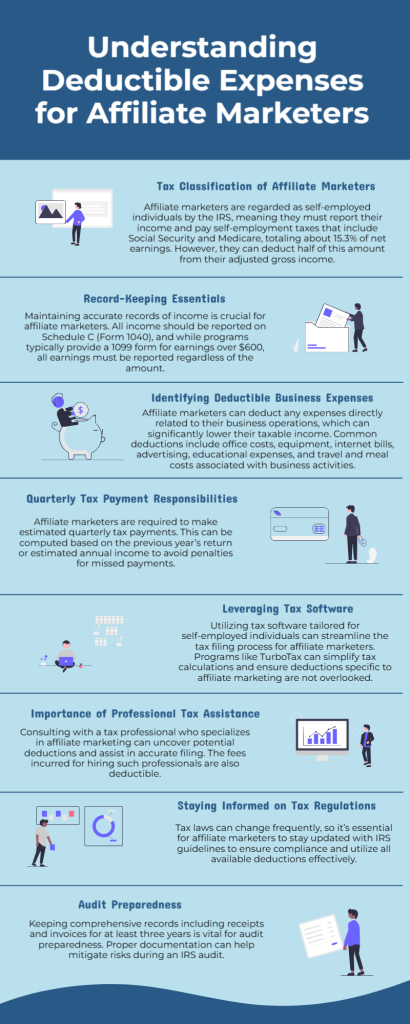

Master the Tax Maze: Deductible Expenses for Affiliate Marketers

By Duncan Whitmore

DISCLAIMER: The information in this article is not financial advice and should not be relied upon to assess your tax compliance. The authors accept no liability for any error or inaccuracy in the information provided. You are advised to seek the opinion of a professional before making decisions.

* * * * *

Navigating the world of taxes as an affiliate marketer can feel a bit like navigating a labyrinth with a blindfold on.

But fear not! This article is your guiding light to understanding how to legally manage your tax affairs as an affiliate marketer.

We’ll decode the perplexities of tax terms and help you leverage those all-important deductions.

Understanding Your Tax Obligations

Let's look at the basics first.

As an affiliate marketer, you're essentially a self-employed individual. That means the IRS considers you a business entity, even if it feels like you’re just a one-person operation.

Here’s the kicker: this means you must report your income and pay self-employment taxes.

Self-employment tax covers Social Security and Medicare, equating to about 15.3% of your net earnings.

It's a significant chunk, but the silver lining is you can deduct half of this amount when you calculate your adjusted gross income.

Keeping Track of Income

Accurate record-keeping is your best friend. You’ll need to report all income received through affiliate programs on your Schedule C (Form 1040).

The good part? Most affiliate programs provide you with a 1099 form if you’ve earned more than $600 in a year.

But even if you haven’t hit that threshold, all income is still reportable. Tools like accounting software can simplify keeping track of your income and expenses throughout the year.

Identifying Deductible Expenses for Affiliate Marketers

Now, here's where things get interesting: deductible expenses for affiliate marketers.

Essentially, any cost that directly contributes to conducting your business can be deducted from your taxable income, thereby reducing your tax liability.

1. Office Expenses: Whether you're renting an office space or using part of your home, you can deduct expenses directly related to your workspace. The simplified home office deduction scheme allows you to deduct $5 per square foot for your home office, up to 300 square feet.

2. Equipment and Supplies: Every laptop, printer, paper clip, or ballpoint pen that helps you manage your affiliate business can be deducted. Remember depreciation of larger equipment and consult the IRS guidelines for which percentage is applicable.

3. Internet and Utilities: Keep those pesky internet bills! If the internet is crucial for your marketing business, a percentage of your internet bill is deductible. Make sure to calculate the portion that’s used for business.

4. Advertising Costs: Any money spent on promoting your affiliate links, whether it's Facebook ads or email marketing software, can be deducted.

5. Educational Expenses: Invest in courses or seminars to hone your marketing skills? Those costs are deductible.

6. Travel and Meals: If you're out there networking or attending industry conferences, travel expenses, lodging, and 50% of meals can be deducted. Ensure these expenses are directly related to your business activities.

Estimating Quarterly Taxes

As an affiliate marketer, you’re required to make estimated tax payments quarterly. This usually confuses many marketers, but missing these payments can result in penalties.

Estimate your quarterly tax payments based on last year's tax return or your estimated annual income.

Utilizing resources like IRS Form 1040-ES can help break down these payments into manageable chunks.

Using Tax Software

While it’s possible to file taxes the old-fashioned way, leveraging tax software designed for self-employed individuals can save you both time and a ton of headaches.

Software like TurboTax or QuickBooks can guide you through the nuances, ensuring you’re not missing out on valuable deductions.

Many of these platforms offer a questionnaire that tailors the experience to maximize deductions specific to affiliate marketers.

Consulting a Tax Professional

Sometimes, you just can’t beat a human touch. Partnering with a tax professional who understands the affiliate marketing industry can be invaluable.

Not only can they help with filing your taxes, but their expertise can uncover deductions you might miss on your own.

Remember, the cost of hiring a tax professional is itself a deductible expense!

Staying Updated with IRS Guidelines

Tax laws aren’t set in stone; they’re more like shifting sand dunes. Staying updated with IRS guidelines is crucial because tax laws can change every year.

The IRS website might not be the most thrilling read, but it's the most authoritative resource on the latest tax laws and deductions.

Preparing for an Audit

The thought of an IRS audit can send shivers down the spine. But with good record-keeping, you can clear hurdles without fear.

Hang onto every receipt, invoice, and bank statement for at least three years. The IRS can audit returns filed within the last three years but may look back farther if they identify a significant error.

Final Thoughts

Managing taxes as an affiliate marketer doesn’t have to be a nightmare. By staying organized, leveraging deductions, and seeking professional assistance, you can transform tax season from a feared foe to a manageable task.

Remember, taking control of your taxes isn't just about compliance; it's about empowering you to grow your affiliate marketing business effectively and responsibly.

* * * * *